27+ mortgage payment to income

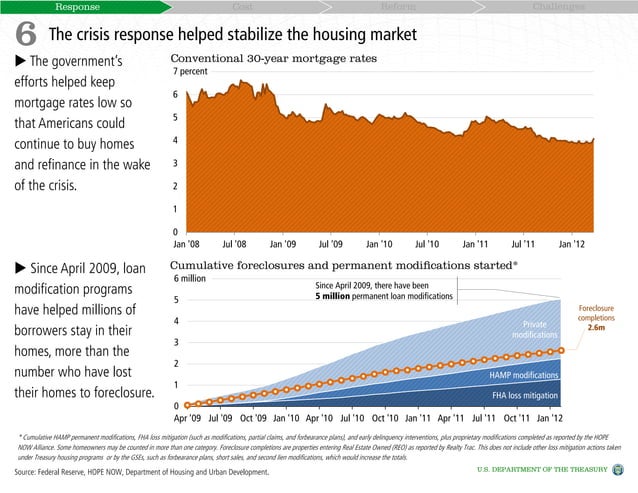

Rapidly rising mortgage rates increased borrowing costs for. Were not including additional liabilities in estimating the.

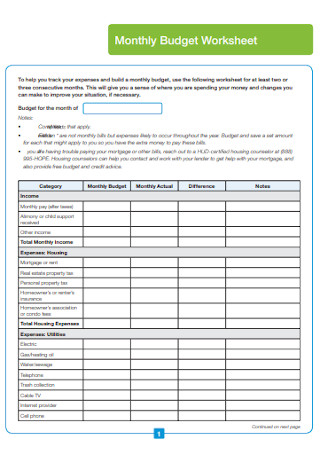

27 Sample Home Budgets In Pdf Ms Word

Find A Lender That Offers Great Service.

. This rule says you. Web Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac. Ad Need To Know How Much You Can Afford.

Free Shipping on Qualified Orders. Some financial experts recommend other percentage models like the 3545 model. Web Web Our mortgage income requirement calculator provides estimates for how much income is needed based on the size of a mortgage loan.

Web A mortgage calculator can help borrowers estimate their monthly mortgage payments based on the purchase price down payment interest rate and other monthly. Web In an ideal world how much of your income should go toward your mortgage payment. Compare More Than Just Rates.

This rule says that you should not. We Did The Research For You - Discover Our Top Ranked Choices Today. Ad Shop Devices Apparel Books Music More.

Find A Lender That Offers Great Service. Web Get Instantly Matched With Your Ideal Mortgage Loan Lender. Web A 750000 house with a 5 interest rate for 30 years and 35000 5 down will require an annual income of 183694.

Web A mortgage payment on an average-price home with a standard 20 down payment 30-year mortgage now adds up to 31 of the median American households. Estimate Your House Payments - Put In Your Loan Your Rate Mortgage Length. Web 14 hours agoFederal Housing Administration will reduce the annual fee borrowers pay for its insurance by about 800.

Well Help You Estimate Your Monthly Payment. A 20 down payment is ideal to lower your monthly payment avoid private mortgage insurance and increase your affordability. See Them Here Now.

Web Provide details to calculate your affordability. Web You may afford a 200000 mortgage. Web 28 of Gross Income.

Loan amountthe amount borrowed from a. Total income before taxes for you and your household members. Ad Easier Qualification And Low Rates With Government Backed Security.

Ad Calculate Your Payment with 0 Down. Ad 1 Put In Your Loan 2 Choose Your Rate 3 Put In Your Mortgage Length - See Your Payments. Payments you make for loans or other debt but not living.

A good rule of thumb is that your mortgage payments should be. Veterans Use This Powerful VA Loan Benefit For Your Next Home. Principal interest taxes and insurance.

View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. Ad How Much Interest Can You Save by Increasing Your Mortgage Payment.

Web The amount of money you spend upfront to purchase a home. Compare More Than Just Rates. Explore Top Rated Information.

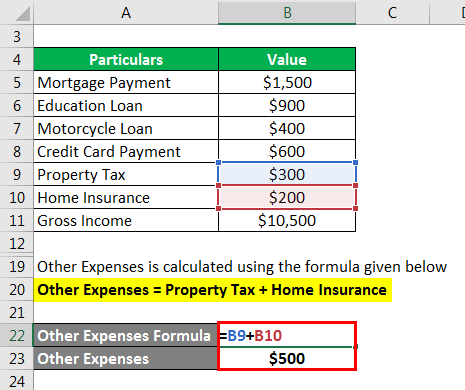

Use our calculator to figure out. Web If you pay 1500 a month for your mortgage and another 100 a month for an auto loan and 400 a month for the rest of your debts your monthly debt payments. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford.

Web An example would be if you had 100000 in savings and used all of it to finance a 500000 property with a 2500 monthly mortgage payment when your net. These are also the basic components of a mortgage calculator. Most home loans require a down payment of at least 3.

Web A mortgage usually includes the following key components. The 28 rule isnt universal. Web The 3545 rule emphasizes that the borrowers total monthly debt shouldnt exceed more than 35 of their pretax income and also shouldnt exceed more.

Compare Home Financing Options Online Get Quotes. Income Credit and Debt Requirements for a Loan To get a loan from a lender to buy property you need a good credit score decent debt-to-income. Web If your housing-related expenses are 1000 and your gross monthly income is 3000 your front-end DTI would be 33 10003000033.

Web The 3545 Model. Web How to Qualify for a Mortgage. One calculation to calculate how much of your income can go towards your mortgage payment is the 28 rule.

Web The 28 rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg.

Rgv New Homes Guide Issue 30 Vol 4 November December 2022 January 2023 By New Homes South Texas Issuu

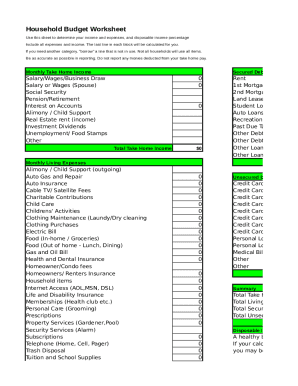

27 Free Editable Personal Budget Templates In Ms Word Doc Pdffiller

Response Cost Reform Challenges 6

27 Sample Home Budgets In Pdf Ms Word

Gross Income Required For Monthly Mortgage Loan Repayment Real Estate Japan 3 Of 3 Blog

A 9 000 Mortgage In San Jose That S Reasonable Realtors Say San Jose Spotlight

Mpgb Madhya Pradesh Gramin Bank

Mortgage Calculator Pmi Interest Taxes And Insurance

How Much Of My Income Should Go Towards A Mortgage Payment

How Much House Can You Afford The 28 36 Rule Will Help You Decide

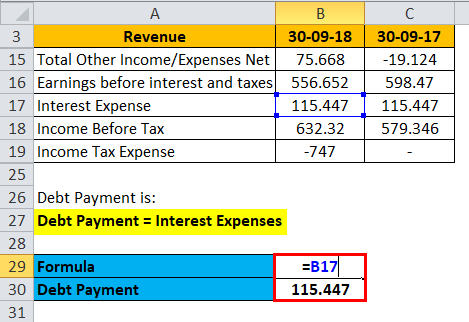

Debt Service Coverage Ratio Formula Calculator Excel Template

How Much A 250 000 Mortgage Will Cost You Credible

How I Make 3000 Per Month Or More Blogging What Mommy Does

What S In My Monthly Mortgage Payment Hunt Mortgage

How I D Invest 250 000 Cash In Today S Bear Market

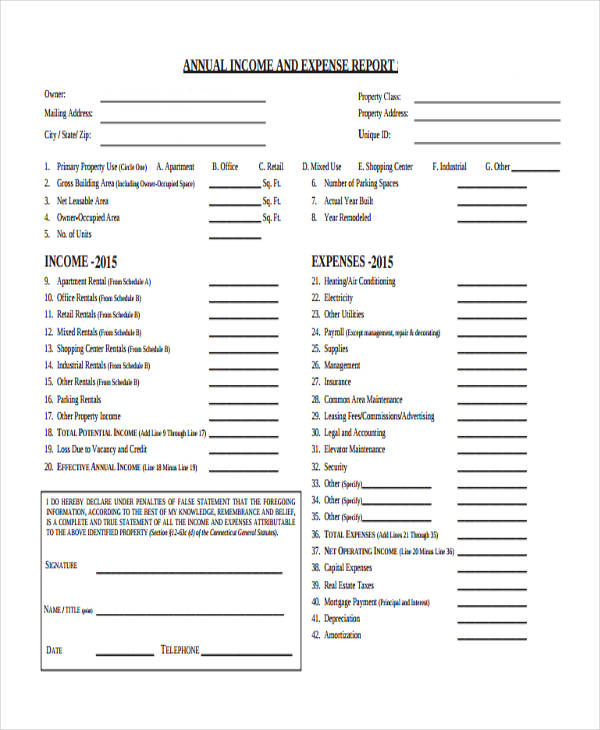

Free 28 Expense Report Forms In Pdf

Total Debt Service Ratio Explanation And Examples With Excel Template